Table of Contents

Disclaimer: This article provides general information about AI investment opportunities and is not intended as investment advice. Before making any investment decisions, readers should consult with financial professionals or other trusted advisors. It’s worth noting that the author of this article holds investments in several of the public companies and ETFs discussed, as well as stakes in various private venture opportunities and startups. Always conduct your own research and due diligence before making any financial decisions.

The realm of AI investment is experiencing an unprecedented boom. As the digital age unfolds, Artificial Intelligence is no longer a distant dream but an evolving reality, reshaping industries and redefining innovations. With this transformation comes a golden opportunity for investors to capitalize on AI’s exponential growth. This guide dives deep into the diverse avenues available for those looking to harness the potential of AI’s financial landscape. Whether you’re a seasoned investor or just stepping into the world of tech investments, understanding the intricacies of AI investment is pivotal to positioning yourself for success in this burgeoning sector. Let’s embark on this journey and unveil the promising prospects that await.

1. Direct Stock Investments into the ‘Magnificent 7’

In the first half of 2023, the below 7 companies contributed to almost all of the S&P500 growth which had led many to shift from FAANG to the AI heavy ‘Magnificent Seven’. These titans have not only demonstrated their prowess in AI innovations but also their resilience and growth in a rapidly evolving sector.

Leading AI Companies for Direct Investment

- Google (Alphabet Inc.): Positioned at the AI vanguard, its influence spans from search algorithms to autonomous driving via Waymo. Not to mention, DeepMind’s breakthroughs consistently revolutionize AI research.

- Facebook (Meta Platforms, Inc.): Beyond its core social media, Facebook’s AI investments are robust. It’s making waves in natural language processing, computer vision, and the expansive world of virtual reality.

- Apple Inc.: Siri might be its poster child, but Apple’s AI advancements permeate its entire device ecosystem, promising an integrated AI-driven user experience.

- Amazon: Beyond its retail giant status, Amazon’s AI innovations stand out, especially Alexa. Add to that, its cloud arm, AWS, and its delve into robotics.

- Microsoft: Microsoft’s AI journey is multifaceted, from its extensive AI tools in Azure to pioneering chatbots like Tay and Zo.

- Tesla: Beyond revolutionizing electric vehicles, Tesla’s AI-powered self-driving technologies are setting industry standards. Their neural network training for autonomous driving is notably groundbreaking.

- NVIDIA: Initially a graphics card manufacturer, NVIDIA is now a key player in AI hardware, thanks to their GPUs becoming a standard in AI computations and deep learning.

Merits of Direct Stock Investments

- Stability: These industry stalwarts provide the assurance of strong balance sheets, established market dominance and relentless commitment to AI innovations.

- Dividend Potential: Giants like Apple and Microsoft often disburse dividends, offering investors an added bonus.

- Upside Potential: With AI’s trajectory aimed skyward, these frontrunners are poised for promising capital appreciation.

Key Takeaways Before diving headfirst into stock investments, comprehensive research is paramount. The tech world, AI included, can be notoriously unpredictable. Grasp the AI roadmap of each entity, their diverse revenue funnels, and AI’s role in their future endeavors. Regularly track sectoral updates, since industry realignments, tech breakthroughs, or even regulatory shifts can sway stock valuations.

Conclusively, investing directly in the stocks of AI luminaries combines the allure of growth prospects with the foundation of market stability. With informed decisions and an ear to the ground, investors are well-equipped to navigate the flourishing AI investment landscape.

2. AI-focused Exchange Traded Funds (ETFs)

For investors keen on harnessing the growth potential of AI but wary of the risks associated with individual stock picks, AI-focused Exchange Traded Funds (ETFs) might be the silver bullet. These funds amalgamate a variety of AI-related stocks, offering a diversified approach to AI investment.

Understanding the Basics

An ETF is akin to a mutual fund, albeit with a twist: ETF shares trade on stock exchanges much like individual stocks. This blend of mutual fund diversification with stock-like flexibility has been a game changer for many investors.

Advantages of Investing in AI-focused ETFs

- Diversification: By holding a range of AI-centric companies, these ETFs minimize the risk posed by the underperformance of any single entity.

- Liquidity: Being exchange-traded, these funds offer a level of liquidity akin to stocks, allowing easy buy/sell operations during market hours.

- Cost-Effectiveness: With their passive investment style, mirroring a specific index, these ETFs typically have lower expense ratios compared to actively managed funds.

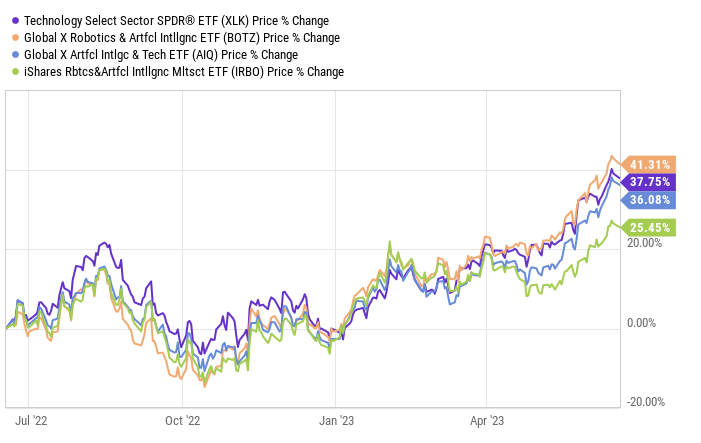

Performance of Notable AI Focused EFTs over the last 12 months

Notable AI-focused ETFs

- XLK – Technology Select Sector SPDR Fund

- Overview: XLK represents the tech sector from the S&P 500, encapsulating giants like Apple, Microsoft, and NVIDIA. While not exclusively AI-focused, its strong tech concentration inevitably touches upon AI’s sphere, given the intertwined nature of modern tech.

- Holdings: Apart from the tech behemoths, the fund has stakes in communication services, hinting at the AI-driven future of communication.

- BOTZ – Global X Robotics & Artificial Intelligence ETF

- Overview: BOTZ is laser-focused on the robotics and AI space. It provides investors an inroad into companies vested heavily in industrial robotics, automation, AI, and related areas.

- Holdings: This ETF is global, featuring companies from Japan, the U.S., Switzerland, and beyond, promising a diverse geographical AI exposure.

- AIQ – Global X Future Analytics Tech ETF

- Overview: AIQ goes beyond just AI, encompassing the broader analytics and big data sector. This provides a unique blend where AI tools are leveraged for big data insights, a combo poised for monumental growth.

- Holdings: AIQ’s portfolio spans diverse sectors like IT, healthcare, and finance, all of which are adopting AI tools at an accelerated pace.

- IRBO – iSTOXX Global Artificial Intelligence and Robotics ETF

- Overview: ARBO is a more recent entrant but has already made a mark. Targeting global companies innovating in AI and robotics, it offers a comprehensive AI investment avenue.

- Holdings: From AI software developers to hardware manufacturers, ARBO’s blend ensures multiple touchpoints within the AI ecosystem.

Things to Consider

- Research the Holdings: Before taking the ETF plunge, scrutinize the underlying stocks it holds. The fund’s success is intrinsically tied to their performance.

- Sectoral Concentration: While diversification is a hallmark of ETFs, some AI-centric funds might lean heavily towards certain sectors, like tech or health. Ensure this aligns with your investment strategy.

- Costs: Even if typically lower than mutual funds, ETFs still come with costs. Keep an eye on the expense ratio to gauge the fund’s cost-effectiveness.

- Dividends: Some AI ETFs might periodically disburse dividends. While a boon for investors, it’s essential to understand the fund’s dividend policy.

AI-focused ETFs offer a balanced route to tap into the meteoric rise of artificial intelligence, marrying diversification’s safety with the dynamism of the stock market. As AI continues to infiltrate every industry niche, these ETFs stand poised to capture this expansive growth. However, as with any investment vehicle, due diligence is essential.

3. AI Investment into Startups through Venture Capital

While the stock market offers the allure of trading well-established AI companies, there exists an equally, if not more, enticing realm for the more risk-tolerant investors: AI startups. These budding companies, burgeoning with innovative ideas and solutions, often need capital to scale their operations, and this is where venture capital (VC) steps in.

Grasping Venture Capital

Venture capital is a form of private equity where investors, often organized into funds, offer startups capital in exchange for equity in the company. It’s a high-risk, high-reward game: while many startups may fail, a successful one can offer exponential returns.

Why Consider AI Startups?

- Exponential Growth Potential: Many AI startups are developing groundbreaking solutions that have the potential to revolutionize industries. Investing early can yield massive dividends if the startup succeeds.

- Innovation Nexus: AI startups often operate at the cutting edge of technology, pushing boundaries and crafting next-generation solutions.

- Strategic Partnerships: Investing in a startup isn’t just about capital. It can lead to partnerships, influencing product development, and gaining early access to innovative solutions.

Navigating the Venture Capital Landscape

- Identify Promising Startups: This involves meticulous research, attending industry events, networking, and liaising with incubators and accelerators.

- Due Diligence: Before investing, conduct thorough checks into the startup’s financial health, team credibility, business model, and market potential.

- Negotiate Terms: This involves deciding the amount to invest, equity stake, and any terms related to the investment.

Potential Pitfalls

- High Risk: The startup realm is fraught with failures. Many startups don’t make it past the first few years, which can result in substantial losses.

- Liquidity Concerns: Unlike stocks, VC investments aren’t easy to liquidate. Your money could be tied up for years.

- Market Dynamics: The rapid evolution of AI means a startup’s promising solution could become obsolete quickly.

Venture Capital Success Stories in AI

Highlighting past successes can provide insight into the potential of VC in AI:

- DeepMind: Before Google’s acquisition, DeepMind was backed by notable VCs, showcasing the potential windfall for early investors.

- Zymergen: A bio-based AI startup, Zymergen attracted significant VC attention before going public.

In Conclusion

Venture capital offers a unique avenue for AI investment, allowing investors to be at the forefront of innovation and potentially reaping monumental rewards. However, it’s crucial to approach with caution, armed with research and understanding of the intricacies of the AI and VC landscapes.

4. Betting on Cloud Computing Companies

As AI models grow in complexity and data processing requirements, the demand for powerful computing resources rises in tandem. The backbone supporting these intensive AI operations? Cloud computing. Investing in cloud companies is an indirect yet effective method to gain exposure to the burgeoning AI market.

Why Cloud and AI Go Hand-in-Hand

- Data Storage: AI models, especially those in deep learning, require massive datasets for training. Cloud platforms provide the necessary storage solutions to handle these data volumes efficiently.

- Computational Power: Training AI models necessitates powerful computational capabilities. Cloud providers offer scalable resources, allowing businesses to access vast computing power on demand without the need for hefty investments in physical infrastructure.

- AI Services: Leading cloud providers now deliver AI-as-a-Service (AIaaS), providing businesses with ready-to-use AI tools and solutions without the complexities of developing them in-house.

Leading Cloud Providers Benefitting from AI Growth

- Amazon Web Services (AWS): As Amazon’s most profitable division, AWS offers a suite of AI services ranging from machine learning platforms to chatbot creation tools.

- Microsoft Azure: Azure AI offers comprehensive solutions, from vision and speech recognition services to machine learning and knowledge mapping.

- Google Cloud Platform (GCP): Leveraging Google’s AI expertise, GCP has integrated AI tools like AutoML and BigQuery ML, offering seamless AI integration for businesses.

- IBM Cloud: With Watson under its belt, IBM Cloud integrates cognitive solutions and AI tools for businesses across sectors.

Factors to Consider When Investing

- Market Saturation: While cloud computing is on the rise, it’s essential to assess if a particular market segment is nearing saturation or still has growth potential.

- Competitive Landscape: New entrants are constantly challenging established players. Stay updated on the latest innovations and potential disruptors in the space.

- Integration Capabilities: A cloud provider’s ability to seamlessly integrate with a range of software tools, databases, and AI platforms can be a strong indication of its future potential.

The Bottom Line

Betting on cloud computing companies is a strategic AI investment avenue. As AI’s demands continue to grow, the cloud serves as its digital scaffold, making cloud providers integral to AI’s future. Investors should, however, approach this segment with an informed perspective, understanding the intricacies and dynamics of the cloud-AI ecosystem.

6. AI Hardware Manufacturers: The Backbone of AI Operations

AI’s remarkable feats, ranging from deep learning models to real-time data processing, are only as powerful as the hardware they run on. As we progress further into the age of artificial intelligence, the infrastructure facilitating these advances becomes crucial. Investing in AI hardware manufacturers provides a tangible route to tap into the AI investment sector.

Understanding the AI Hardware Landscape

- Graphical Processing Units (GPUs): Originally designed for rendering graphics in video games, GPUs have emerged as the preferred hardware for training deep learning models due to their parallel processing capabilities.

- Tensor Processing Units (TPUs): Customized by Google for its machine learning tasks, TPUs are designed to accelerate tensor operations, a fundamental aspect of deep learning.

- Field-Programmable Gate Arrays (FPGAs): FPGAs are integrated circuits that can be reconfigured post-manufacturing, offering adaptability and efficiency in AI operations.

- Application-Specific Integrated Circuits (ASICs): Customized for specific applications, ASICs are optimized for particular tasks, ensuring high performance for those dedicated functions.

Key Players in the AI Hardware Market

- NVIDIA: Pioneering the use of GPUs for AI, NVIDIA has established itself as a dominant force, especially with products like the Tesla and A100 GPUs tailored for deep learning.

- Intel: With its acquisition of Altera, a major FPGA manufacturer, and Nervana, an AI chipset company, Intel is positioning itself to be a heavyweight in the AI hardware landscape.

- AMD: As a competitor to NVIDIA in the GPU market, AMD’s Radeon Instinct accelerators are aimed at AI and machine learning workloads.

- Google: The development of TPUs underscores Google’s commitment to leading the AI hardware race.

The Importance of Investing Wisely

- Innovation Pace: The rapid pace of innovation in AI hardware means that today’s leading technology might be overshadowed tomorrow. It’s essential to invest in companies that consistently innovate and evolve.

- Supply Chain Challenges: External factors, like global chip shortages, can influence production and profits. Understanding these dynamics is crucial for potential investors.

AI hardware manufacturers serve as the backbone of AI operations, propelling the innovations and capabilities of artificial intelligence. While the AI software captures most of the limelight, it’s the silent efficiency of the hardware that truly powers this revolution. By investing in these hardware giants, one is not just investing in a company but in the very infrastructure of the AI-driven future.

7. Participate in Initial Public Offerings (IPOs) of AI Companies#

Initial Public Offerings, or IPOs, are often one of the most exhilarating phases in a company’s lifecycle. It marks the transition of a firm from a private entity to a public one, allowing the general public to buy shares and have a stake in its future. For investors keen on AI investment, participating in the IPOs of promising AI companies can be a direct ticket to this burgeoning industry’s growth story.

Why IPOs?

- First-Mover Advantage: Investing in an IPO allows you to buy shares at the initial price, often before the stock’s potential surge in the open market.

- Growth Potential: Many AI startups have shown tremendous growth in their early stages. An IPO can be a sign that the company is poised for further expansion.

- Portfolio Diversification: Adding freshly IPOed AI companies can provide a new dimension to your investment portfolio, balancing established giants with potential breakout stars.

Risks and Considerations

However, like all investments, participating in IPOs comes with its set of risks:

- Overvaluation: There’s always the risk that the hype surrounding an AI company’s IPO leads to an inflated stock price, which might correct post listing.

- Limited Historical Data: Newly public companies lack the extensive public financial track record that established firms provide, making analysis more challenging.

- Volatility: Shares of newly listed companies can experience significant price volatility, especially in the initial days after the IPO.

How to Participate in an AI Company’s IPO

- Research: Before investing, delve deep into the company’s prospectus, understand its business model, revenue streams, and competitive positioning in the AI landscape.

- Brokerage Account: Ensure you have an account with a brokerage firm that has access to IPO offerings.

- Indicate Interest: Once you’ve zeroed in on an AI company’s IPO, indicate your interest and the number of shares you’d like to purchase through your broker.

Is 2024 the IPO window?

The IPO market has had a quiet 2022 and 2023 so far with many predicting a pick up at the end of this year going into 2023. This could mark the beginning of a rush to market from many of the AI companies who have to date raised venture capital as unlisted businesses. The market will be watching the leaders in this space and once, one succesfully IPOs, its likely that many will follow. Its normally the case that you need to be in the first movers who will have to be priced attractively in order to attract investors. My personal view is that this is an attractive position to target.

Conclusion

While participating in the IPOs of AI companies can be a direct route to harnessing the industry’s growth, it’s essential to approach this with a well-researched strategy. Balancing the potential rewards with the inherent risks, and keeping abreast of the ever-evolving AI landscape, ensures that you’re well-positioned to make the most of your AI investment journey.

8. Robotics and Automation Stocks: AI’s Tangible Implementations

While artificial intelligence often seems like an abstract concept to many, its tangible manifestations are undeniably present in the realm of robotics and automation. Companies in this sector are integrating cutting-edge AI technologies to create machines that can think, learn, and act in ways that were once the domain of science fiction.

Why Robotics and Automation?

- Ubiquitous Integration: From manufacturing plants to home cleaning robots, automation powered by AI is becoming an integral part of our daily lives.

- Economic Efficiency: Robots, once programmed, can work tirelessly without breaks, leading to increased production efficiency and reduced operational costs.

- Technological Advancements: The rapid progress in AI algorithms, combined with improvements in hardware, has paved the way for more sophisticated and versatile robots.

Leading Robotics and Automation Stocks

When considering AI investment in the robotics and automation sector, these companies stand out:

- ABB Ltd: A global technology leader that focuses on robotics, machine automation, and electrification. Their robots are used in industries ranging from car manufacturing to electronics.

- Fanuc Corporation: A Japanese company renowned for its CNC systems and industrial robots. Their products are fundamental in automotive and electronic manufacturing.

- iRobot Corporation: Best known for its Roomba, iRobot has diversified its portfolio to include robots for mopping, lawn mowing, and more.

Factors to Consider

For investors eyeing this sector, it’s essential to:

- Monitor Technological Developments: The pace at which advancements occur can make or break companies in this domain.

- Supply Chain Dependencies: Given the global nature of tech supply chains, disruptions (like chip shortages) can impact production.

- Regulatory Landscape: As robots become more integrated into daily life, governments may introduce regulations that could affect the sector’s growth.

The Future Is Automated

The trajectory of the robotics and automation sector points to a future where many tasks, whether mundane or complex, will be handled by machines. For investors, this presents an exciting opportunity, not just to witness but to partake in this transformative journey of AI investment.

Note: Investing in stocks carries risks, and past performance is not indicative of future results. Always conduct thorough research or consult with a financial advisor before making investment decisions.

9. Financial Derivatives Based on AI Company Performances

Financial derivatives, complex financial instruments that derive their value from an underlying asset or group of assets, have begun to play a prominent role in the investment landscape for artificial intelligence (AI) companies. With the rising prominence of AI firms and their often-volatile stock prices, these derivatives provide a myriad of investment and hedging opportunities for savvy investors.

Understanding the Basics

Financial derivatives related to AI company performances can range from basic options and futures contracts to more advanced swaps and structured products. The primary objective for many investors using these instruments is either speculation (betting on future price movements) or hedging (protecting against potential losses).

Key Derivative Instruments in the AI Realm

- Options: These contracts give the holder the right, but not the obligation, to buy or sell an AI company’s stock at a predetermined price on or before a specific date. They allow investors to speculate on price movements or hedge against adverse price shifts.

- Futures: Standardized contracts obliging the buyer to purchase, and the seller to sell, a specific quantity of an AI stock at a predetermined price on a set future date.

- Swaps: These are agreements between two parties to exchange sequences of cash flows. In the context of AI, it could relate to swapping the interest rates or returns of two AI companies.

- Structured Products: These are pre-packaged investment strategies that might bundle an AI stock with derivatives. They’re designed to offer customized risk-return objectives, catering to specific investor needs.

Why Investors Are Turning to Derivatives for AI Investments

- Flexibility: Derivatives can be tailored to meet specific investment goals, whether it’s maximizing returns or minimizing risk.

- Leverage: They allow investors to gain exposure to AI stocks without necessarily having to buy them outright, often using a fraction of the underlying asset’s price.

- Risk Management: Derivatives can act as insurance, helping investors protect their portfolios against adverse price movements in volatile AI stocks.

Cautions and Considerations

Derivatives are complex and come with their set of risks. It’s essential to:

- Understand the Instrument: Know the mechanics, risks, and rewards of any derivative before investing.

- Stay Updated: AI is a rapidly changing field. Ensure that you’re updated with AI company performances and industry news, which can influence derivative prices.

- Consult Professionals: Given their complexity, it might be wise to seek the counsel of financial advisors or experts in the field.

In the booming realm of AI, financial derivatives based on AI company performances offer a unique avenue for potential gains. However, with increased potential comes increased risk, making it imperative for investors to tread with knowledge and caution.

Conclusion

Artificial Intelligence, a technology once reserved for science fiction, is now profoundly shaping our present and crafting a promising future. Its rapid growth and transformative power have ushered in a new era of investment opportunities, presenting both seasoned and novice investors with a myriad of avenues to tap into this burgeoning sector. From direct stock investments in AI giants like Tesla and Nvidia to nuanced approaches through financial derivatives and start up investing, the AI investment landscape is as diverse as it is dynamic.

However, as with any high-growth domain, the world of AI investments is not without its challenges. The volatility and complexity intrinsic to tech investments mean that knowledge, research, and prudence are paramount. By taking a holistic view, staying informed, and perhaps most crucially, understanding the underpinnings of AI technology and its vast potential, investors can better position themselves to ride the wave of AI’s exponential growth.

The future of AI is bright, and for those willing to navigate its intricate investment pathways, the potential for substantial rewards looms large. As you venture into the realm of AI investment, remember that with great opportunity comes responsibility. Equip yourself with the right knowledge, consult experts when in doubt, and always keep an eye on the horizon. The AI revolution is well underway, and it promises to redefine not just industries, but the very fabric of our global economy. Be part of that change. Embrace the future, and invest in tomorrow, today.

A reminder that none of the above is financial advice and what is presented is for information and educational purposes. If you wish to get real time updates of what i’m doing with my portfolio, join our mailing list today.